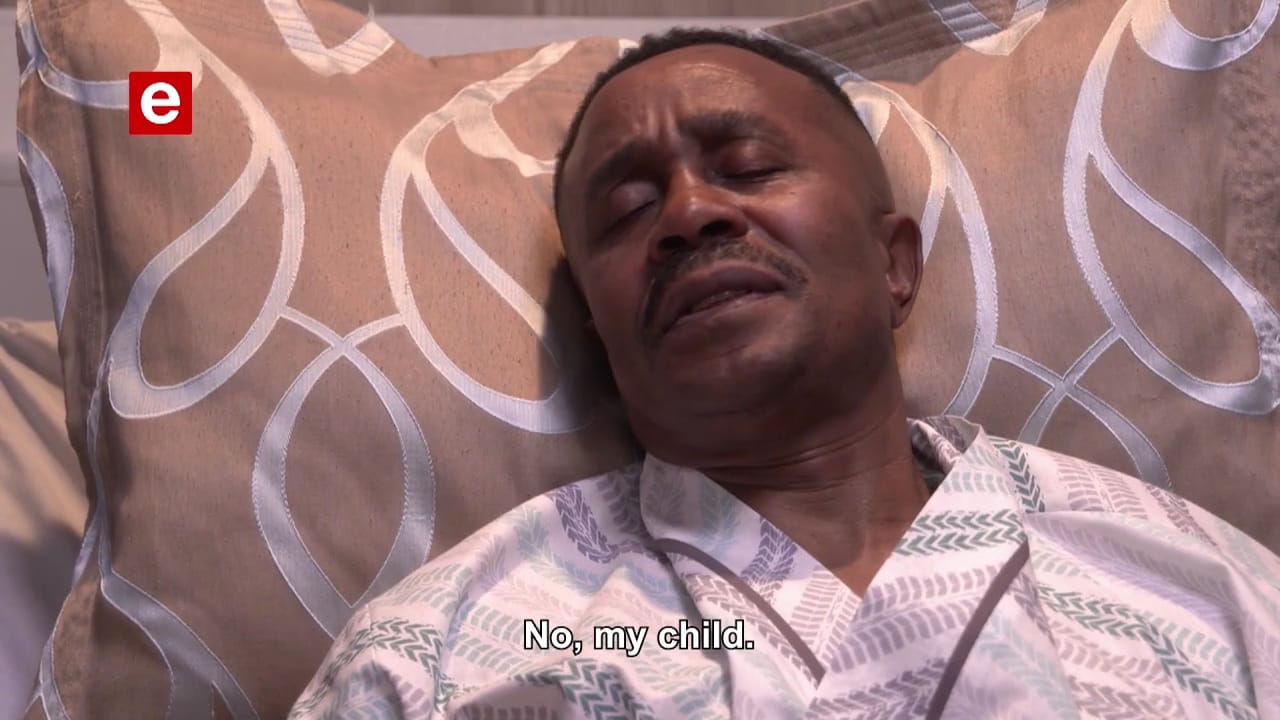

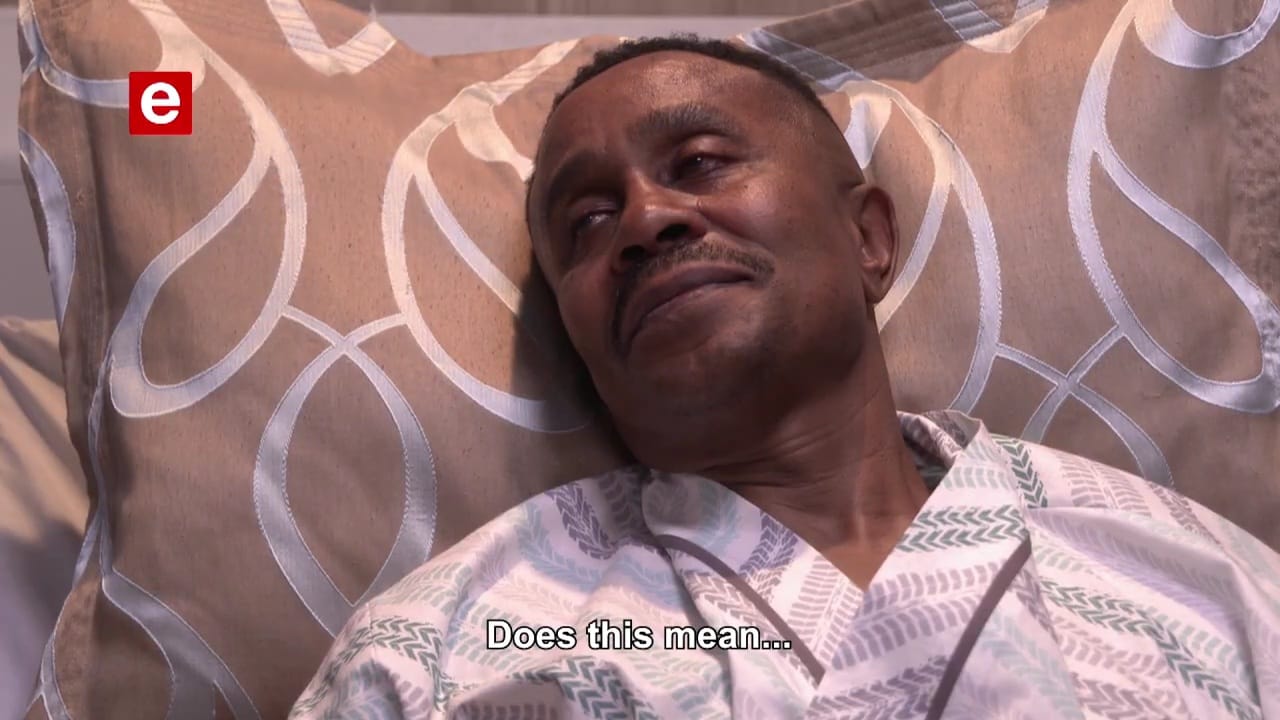

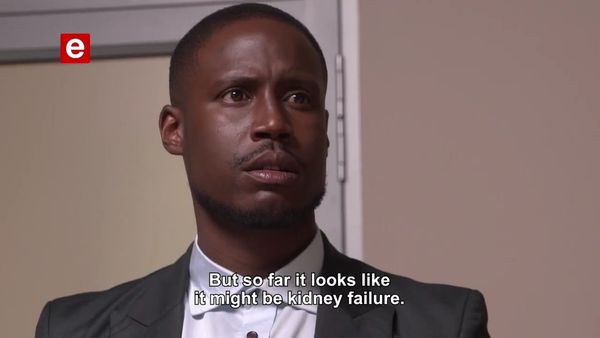

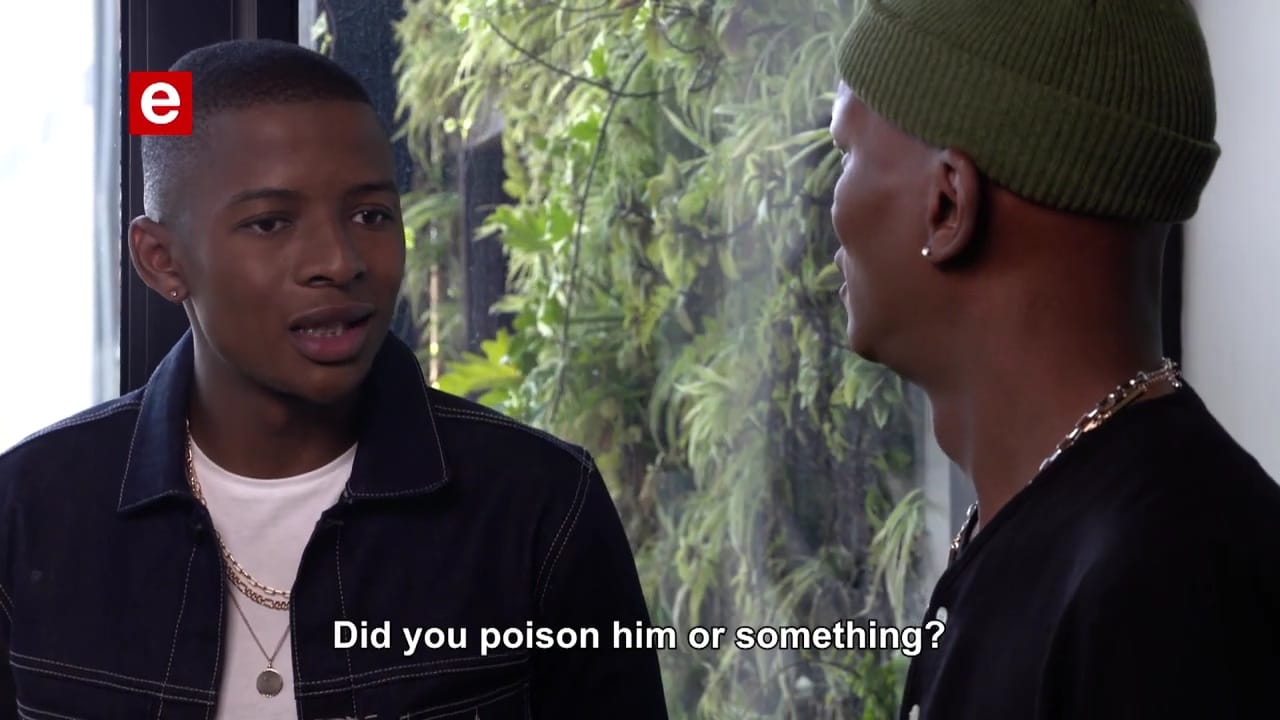

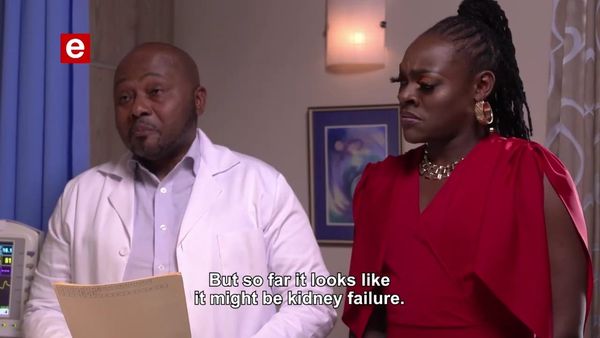

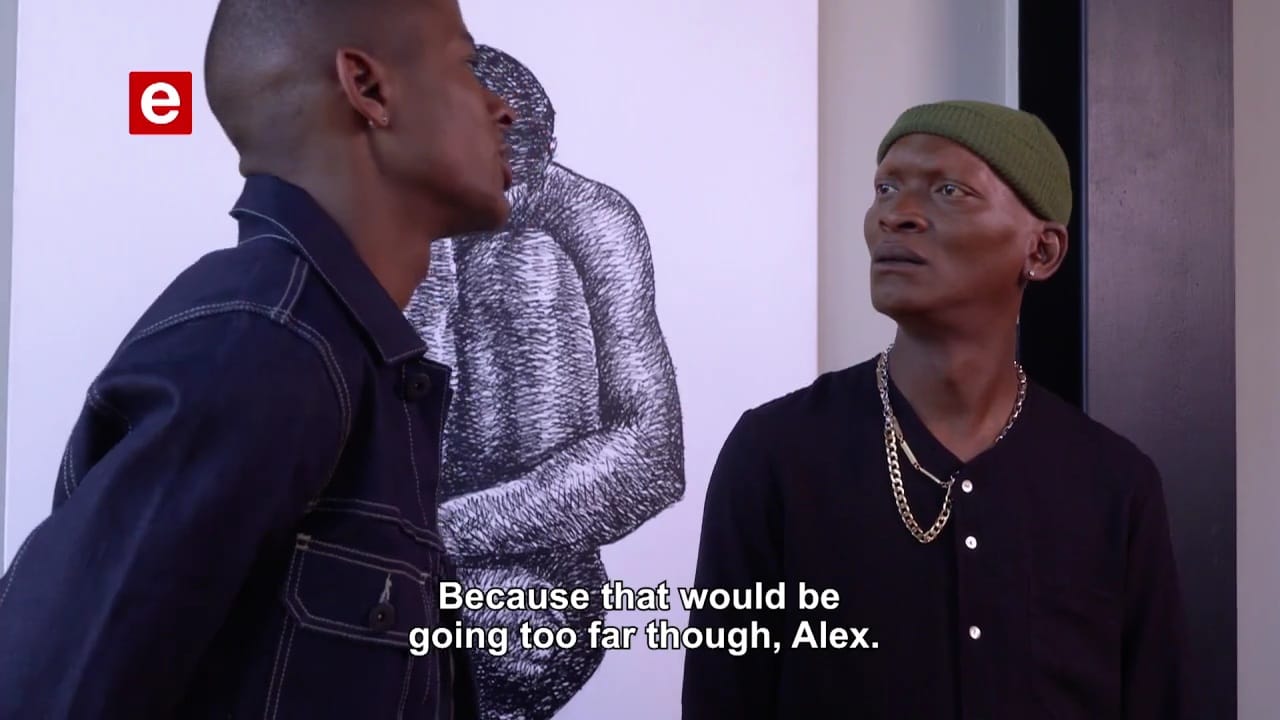

Ona takes over as Funani falls ill

The results of Funani’s tests will provide evidence to support the conclusion that she is not in good health. While he is on his deathbed, Funani will continue to impart wisdom to Ona regarding the management of the company as well as the lessons he has learned throughout his life. That is all the information that we have at this time; we will keep you updated as soon as we learn anything else. But before you leave, here is a well-written article that will walk you through the steps of inheriting wealth from loved ones or relatives.

How to make a claim on your South African inheritance if you are living outside of the country.

As a result of the termination of the financial emigration process, the procedure for claiming an inheritance has been modified. This applies to South Africans currently living outside of the country. Here is the information that you require.

When you no longer live in the same country as the estate, the process of inheriting something can become more difficult. However, many people will receive some kind of inheritance at some point in their lives.

Taking legal action to claim your South African inheritance in 2021 and beyond. After the passage of the Taxation Laws Amendment Act in March 2021, the practice of financial emigration was finally put to an end (FE).

It was a difficult procedure, but the FE made it possible for South African citizens living abroad who had lost their South African identification to collect their inheritance from the estate of a deceased South African. For the purposes of exchange control, you could declare yourself to be a non-resident with the South African Reserve Bank (SARB) if you engaged in financial emigration. You were able to move assets out of South Africa once it was established that you were not a resident of the country there.

You were able to go through a process known as “belated emigration” rather than using your annual allowance to claim your inheritance if you lived outside of South Africa and didn’t have a South African identification document or tax number. Because financial emigration is no longer an option, belated emigration is no longer something that can be done.

A recent circular that was distributed by the SARB stated that a beneficiary may be eligible to receive an inheritance (or life insurance policy) of up to R10 million even if they have ceased to be resident for the purposes of taxation and are no longer active on the SARS registered database. When dealing with sums that are greater than R10 million, a manual letter of compliance is obligatory.

Demonstrating to SARS that you are no longer considered a tax resident will be a difficult task.

How to make a claim on your inheritance in South Africa according to the new procedure

If you are currently living outside of South Africa and you are the beneficiary of an inheritance from a South African estate, you may fall into one of the following categories:

My inheritance is less than R1 million, and I have my South African identification card.

If you have your identity document (ID book or ID card), you have not tax emigrated from South Africa, and the amount of your inheritance is less than R1 million, then you are eligible to use your R1 million SDA to transfer your funds outside of South Africa.

The procedure is not overly complicated at all.

I am in possession of my South African identification document, and the value of my inheritance is greater than R1 million.